The US Court of Appeals for the Federal Circuit’s recent decision in Exmark Manufacturing Company v. Briggs & Stratton Power Products Group, LLC (January 2018) validates that there is no clear-cut method to value a patented invention’s contribution to a larger, multi-component product (aka apportionment). Specifically, the Federal Circuit stated that “…apportionment can be addressed in a variety of ways…[so] long as [the patent owner] adequately and reliably apportions between the improved and conventional features” of the accused product. Along with providing this leniency, the Federal Circuit provided some (perhaps obvious) guidance to performing a “thorough and reliable analysis to apportion the royalty rate”: perform a “proper analysis of the Georgia-Pacific factors….the standard Georgia-Pacific reasonable royalty analysis takes account of the importance of the inventive contribution in determining the royalty rate that would have emerged from the hypothetical negotiation”. This guidance does not minimize the flexibility offered by the Federal Circuit in determining a reasonable royalty. After discussing some case background, this article found here provides some examples of apportionment methods as are discussed below.

Generally, the Federal Circuit allows the use of the Entire Market Value Rule when supported by the correct facts, but insists that the rule not be misapplied. The Rule may sometimes be justified because it is difficult to know the component’s value to which a percentage royalty is applied. Considering the Georgia Pacific factors in performing a reasonable royalty analyses, Georgia Pacific factor #13 states:

“The portion of the realizable profit that should be credited to the invention as distinguished from non-patented elements, the manufacturing process, business risks, or significant features or improvement added by the infringer”

This apportionment can be one of the more challenging factors in a reasonable royalty analysis. Some circumstances allow a more simple analysis that defines the next best alternative(s) that account for the value of the non-patented elements. Other cases may require more work. Sometimes using multiple apportionment methodologies that arrive at a similar conclusions can strengthen the apportionment value conclusion. Examples of methods to apportion the profit attributable to the patented feature(s) are provided below. Note that these methods may not be appropriate/applicable in all cases. Additionally, each one of these methods by itself may not be sufficient for an apportionment value conclusion

These examples include the following:

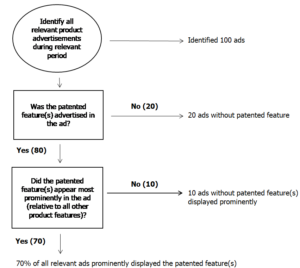

- Advertisements – If the product that contains the patented feature(s) has been advertised during the relevant period, consider the product advertisements. Advertising (or lack thereof) may indicate a measure of value of the patented feature(s). The following flow chart provides a simplified example:

One may be to infer from the above simplified example that much of the product’s value relates to the patented features.

One may be to infer from the above simplified example that much of the product’s value relates to the patented features. - Sales comparison – Compare the volume of product sales that contain the patented feature relative to product sales of otherwise similar product(s) without patented feature(s). A simple example: if two products (one with and one without the patented feature) have similar sales volumes during similar time periods to similar consumers and geographic regions, one may infer that the patented feature may not add much incremental value.

- Required rate of return – Disaggregate the resources used in making the product with the patented feature and calculate the required rate of return on each resource so that the company remains viable. Notably, this method is likely one of the less practicable due to, inter alia, a lack of data available for the calculation.