REI, a retailer of outdoors equipment and clothing, has ended its extremely generous merchandise returns policy. This policy allowed customers to return any REI product, no matter how much time had passed since the date of purchase, no matter the condition of the returned product, and with or without a receipt. REI’s generosity earned it …

Permanent link to this article: https://betweenthenumbers.net/2013/09/in-a-reversal-of-predictions-typing-has-replaced-speaking/

Permanent link to this article: https://betweenthenumbers.net/2013/09/how-the-information-age-might-have-doomed-reis-generous-returns-policy/

Sep 18

President Obama proposes still more tax increases

With debt ceiling talks getting more attention, the issue of tax increases will again be on the table. If you thought last year’s massive tax increase satisfied the “tax the rich” proponents, you are wrong again. Here is a summary of the tax increases President Obama included in his 2014 budget. Although these tax increases …

Permanent link to this article: https://betweenthenumbers.net/2013/09/president-obama-proposes-still-more-tax-increases/

Sep 17

Tax Treatment for Employee Litigation Settlements

The IRS recently issued Chief Counsel Advice (CCA) Memorandum 20133501F, which addresses the appropriate tax treatment for litigation settlements with current or former employees. The guidance was as follows: “When are attorney’s fees paid by an employer as part of a settlement agreement with a former employee subject to employment taxes? In the absence of a …

Permanent link to this article: https://betweenthenumbers.net/2013/09/tax-treatment-for-employee-litigation-settlements/

Sep 16

The Behind the Scenes Cost of Entering the Shark Tank

ABC’s popular reality TV show, “Shark Tank,” features financing negotiations between a panel of venture capitalists (the “Sharks”) and entrepreneurs/small business owners. Like normal venture capital investing, the deals portrayed in the show generally involve an exchange of an equity stake in the company for a certain amount cash that the business requires. The show’s …

Permanent link to this article: https://betweenthenumbers.net/2013/09/the-behind-the-scenes-cost-of-entering-the-shark-tank/

Sep 15

Pay more attention to compensatory damages: Punitive damages remain limited to simple multipliers

In Nickerson v. Stonebridge Life Insurance Company (B234271, Aug. 29, 2013), the California Court of Appeal affirmed the trial court’s reduction of the jury’s punitive damage award to ten times the tort damages. In reaching this decision, the Appellate Court extensively discussed the defendant’s conduct, and its application under federal and California punitive damage law. …

Permanent link to this article: https://betweenthenumbers.net/2013/09/pay-more-attention-to-compensatory-damages-punitive-damages-remain-limited-to-simple-multipliers/

Sep 14

IRS officially recognizes same sex marriages

On August 29, 2013, the Internal Revenue Service (IRS) issued Revenue Ruling 2013-17. Consistent with the U.S. Supreme Court ruling in Windsor, the IRS concludes: “…individuals of the same sex will be considered to be lawfully married under the Code as long as they were married in a state whose laws authorize the marriage of two …

Permanent link to this article: https://betweenthenumbers.net/2013/09/irs-officially-recognizes-same-sex-marriages/

Sep 12

FASB to Alter Reporting for Development Stage Companies

FASB has agreed to work on decreasing financial reporting complexity for development stage companies. FASB defines such companies as those which devote substantially all efforts to establishing a new business and: Have not begun planned principal operations; or Have begun planned principal operations without producing significant revenue. Under existing Generally Accepted Accounting Principles (“GAAP”), development-stage entities must …

Permanent link to this article: https://betweenthenumbers.net/2013/09/fasb-to-alter-reporting-for-development-stage-companies/

Sep 10

Expert Thrown Out After Claiming Major Report “Typos” on Cross

A recently affirmed decision to grant judgment for the defendant as a matter of law in Rembrandt Vision Technologies, Inc. v. Johnson & Johnson Vision Care, Inc. highlights the importance of expert testimony that is consistent with previously disclosed opinions presented in a Rule 26 report. In this matter, the expert’s testimony was struck because …

Permanent link to this article: https://betweenthenumbers.net/2013/09/expert-thrown-out-after-claiming-major-report-typos-on-cross/

Sep 09

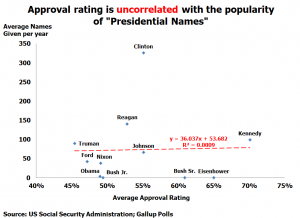

Do “Presidential Names” Become More Popular?

An event study captures the impact of a certain event(s) on a marketplace. This technique is most commonly used in the context of the stock market, when analysts study the effects of certain events on stock prices. Analysts look at share prices prior to the event of interest (e.g. a stock split, CEO resignation, etc.) …

Permanent link to this article: https://betweenthenumbers.net/2013/09/which-presidential-name-is-most-popular/

Sep 23

In a reversal of predictions, typing has replaced speaking

September 23, 2013

When I was in junior high school in the early 90’s, my typing teacher mournfully predicted that typing would soon become an obsolete skill. Before long, computers would type as we dictated. Her prediction was not uncommon at the time. Many were enthralled by the ability of computers to understand and type out spoken words. …

Continue reading