The expected significant change in the estate tax at the end of 2012 should cause most affluent persons to engage in estate planning. Usually, this will involve an irrevocable trust. One issue that invariably arises is how a future estate tax will be paid for those assets that have not been removed from the estate. …

Permanent link to this article: https://betweenthenumbers.net/2012/02/recent-tax-case-approves-use-of-related-party-loans-to-reduce-and-fund-estate-taxes/

Feb 08

Mortgage Tax Relief on Debt Forgiveness Ending This Year!

Normally, when you receive any reduction in the amount of debt you owe someone it is a taxable event. For example, if you owe someone $10,000 and the lender forgives $5,000 of that debt, that $5,000 is consider income and you have to pay tax on that amount. Under the Mortgage Forgiveness Debt Relief Act …

Permanent link to this article: https://betweenthenumbers.net/2012/02/mortgage-tax-relief-on-debt-forgiveness-ending-this-year/

Feb 05

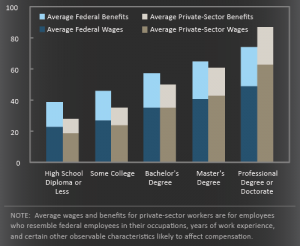

Government employees are compensated 16% more richly than their private sector counterparts

In a study released in January, the Congressional Budget Office (CBO) concluded that, on average, civilian federal employee compensation (including both wages and benefits spending) trumps that of the private sector. Except for individuals with a professional degree or doctorate, the imbalance held true at each education level, including (i) high school diploma or less, …

Permanent link to this article: https://betweenthenumbers.net/2012/02/government-employees-are-compensated-16-more-richly-than-their-private-sector-counterparts/

Feb 03

DOL’s ARB limits SOX whistleblower protections To U.S. employees

By a 3-2 vote, the Department of Labor’s Administrative Review Board (ARB) limited the jurisdiction of the Sarbanes-Oxley Act (SOX) whistleblower protection outside the United States. The case is Villanueva v. Core Laboratories, NV, ARB No. 09-108, ALJ No. 2009-SOX-6 (ARB Dec. 22, 2011) (en banc). The ARB received multiple amicus briefs setting out the …

Permanent link to this article: https://betweenthenumbers.net/2012/02/dols-arb-limits-sox-whistleblower-protections-to-u-s-employees/

Feb 02

IRS issues final regulations on taxation of personal injury damages

In late January, the IRS issued final regulations regarding the taxation of personal injury litigation damages. The regulations provide guidance regarding tax law changes included in the Small Business Job Protection Act passed in 1996. Specifically: Litigation settlements are excluded from gross income for damages received on account of physical injuries or sickness. Damages from …

Permanent link to this article: https://betweenthenumbers.net/2012/02/irs-issues-final-regulations-on-taxation-of-personal-injury-damages/

Feb 02

Super Advertising: $3.5 Million for 30 Seconds

The National Football League’s annual championship game is consistently the most watched American broadcast on television. The 2011 Super Bowl had an average audience of 111 million viewers, which surpassed the record-setting 106.5 million viewers drawn by the 2010 game. It would not be at all surprising if this year’s game surpasses the 111 million …

Permanent link to this article: https://betweenthenumbers.net/2012/02/super-advertising-3-5-million-for-30-seconds/

Feb 01

Best Places to Work

Fortune has released its current list of the “100 Best Companies to Work For”, with Google topping the list for the third time in its history. The highly sought after honor considers criteria such as pay, perks, culture, and job growth. The full list can be found here, but the top twenty companies are: Google Boston …

Permanent link to this article: https://betweenthenumbers.net/2012/02/best-places-to-work/

Jan 31

A Primer on Valuing Options

When used with financial instruments, options are a contract between two parties in which one party has the right, but not the obligation, to do something. Usually, the option involves buying or selling an underlying asset. Having rights without obligations has financial value, so option holders must purchase these rights at a price, called a …

Permanent link to this article: https://betweenthenumbers.net/2012/01/a-primer-on-valuing-options/

Jan 24

Government Entity Uses High-Tech Audit Tools

The Supplemental Nutrition Assistance Program (“SNAP”) is being closely watched with high-tech audit tools. The SNAP program is commonly referred to as the food stamp program. The program began in 1939 in order to assist low income Americans during the Great Depression. The program was overhauled in 1964, 1977 and more currently in 1990s. In …

Permanent link to this article: https://betweenthenumbers.net/2012/01/government-entity-uses-high-tech-audit-tools/

Jan 19

Possible double-counting “new value” in bankruptcy preference actions

A creditor-friendly, minority view comes from a First Circuit District Court. If this rationale catches on, this could have a significant impact on bankruptcy preference litigation. Generally speaking, a “preference” under Section 547 of the Bankruptcy Code is a payment of an old (or “antecedent”) debt. The Bankruptcy Code allows a bankrupt company to recover …

Permanent link to this article: https://betweenthenumbers.net/2012/01/possible-double-counting-%e2%80%9cnew-value%e2%80%9d-in-bankruptcy-preference-actions/