Salesforce.com.com (NYSE: CRM) reported its yearly earnings in February. As a publicly traded company, Salesforce.com is required to issue annual financial reports in accordance with Generally Accepted Accounting Principles, or “GAAP”. While Salesforce.com presents GAAP-based earnings in its SEC filings, its management touts a different metric as the preferred method of measuring the company’s performance. This was evident in the company’s latest conference call transcript, where the CEO and CFO discussed nearly all the operating results in non-GAAP terms. The significantly different earnings result they espouse is calculated by taking the GAAP earnings figure and adding back non-cash items, mainly stock based compensation and amortization.

Salesforce.com reported a GAAP loss of $0.09 per share, in contrast to the associated non-GAAP profit metric described above of $1.36 profit per share. The $1.45 disparity per share between GAAP and non-GAAP earnings is attributable to just three items:

- $229 million of stock based compensation,

- $67 million of amortization, and

- $12 million in net non-cash interest on convertible notes.

Salesforce.com provides many of its personnel with stock options and grants, which can comprise a meaningful portion of one’s employee’s pay. As a component of compensation, these stock options and grants are actual costs incurred by the company. When Salesforce.com’s management uses the non-GAAP earnings figures, the stock based compensation is improperly ignored. As an illustration, consider an individual who decides to take out a second mortgage on his house to pay for a luxurious vacation. Just because this person did not pay for this vacation with cash out of his savings account does not make the trip free. Similarly, earnings that do not reflect stock based compensation are disingenuous because this compensation comes at a cost to the current shareholders, whose equity in Salesforce.com is being diluted.

Salesforce.com’s Chief Financial Officer, Graham V. Smith, consistently speaks of performance under this non-GAAP metric. During the February 23rd conference call, Smith stated “For the full year, operating expenses as a percent of revenue was 70% compared with 68% last year.” However, taking into account stock based compensation results in an increase of 5.4 percentage points in operating expenditures. Similarly, Smith’s representations that “Fourth quarter non-GAAP operating margins rose by 2 points year-over-year to 13%. For the full year, non-GAAP operating margins fell 2 points to 12% from last year.” are also misleading because Salesforce.com posted a net loss for the fourth quarter and an operating loss for the full fiscal year under GAAP.

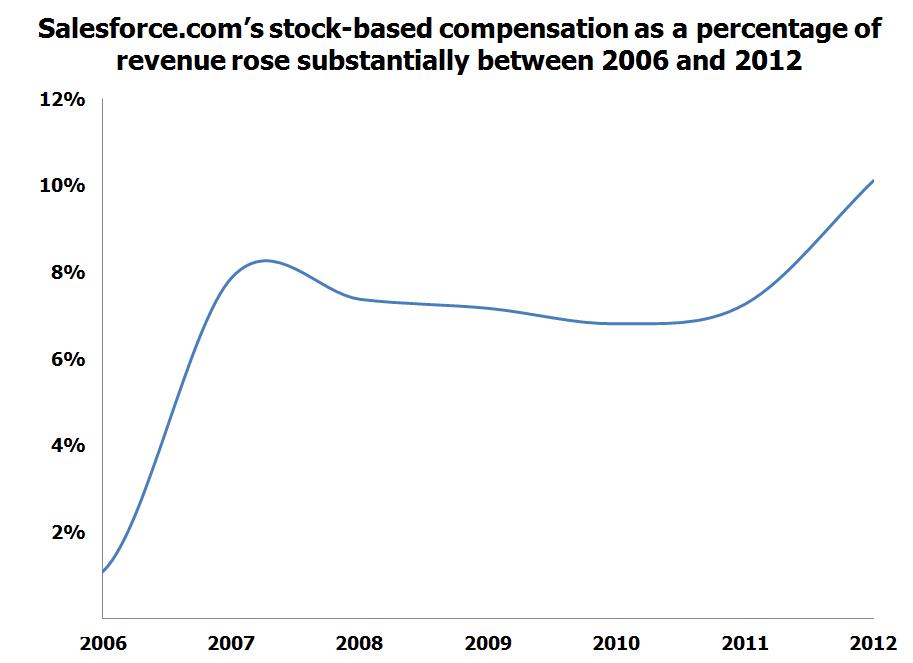

Salesforce.com’s undisclosed costs are increasing. The amount of stock-based compensation granted was less than $3.5 million in 2006, but over $229 million in 2012. It also increased as a percentage of revenue throughout the years, to over 10% in 2012.

The discrepancy between Salesforce.com’s GAAP earnings and those which management focuses on in public statements is likely to get even bigger, as they have already announced in their 2013 guidance that they intend to employ another $368 million of stock based compensation, a 60% increase from the prior year.

There is a reason that GAAP requires such compensation to be deducted in calculating earnings. Investors should consider these very real costs when making their investment decisions.