A slew of new federal taxes related to the Patient Protection Affordable Care Act (PPACA) took effect January 1, 2013. Like most taxes, the tax imposers will try to mask the impact by aggregating them with other taxes. Because consumers are used to paying some type of tax on practically everything, they are less likely to question or understand the now larger lump sum “Tax”.

A slew of new federal taxes related to the Patient Protection Affordable Care Act (PPACA) took effect January 1, 2013. Like most taxes, the tax imposers will try to mask the impact by aggregating them with other taxes. Because consumers are used to paying some type of tax on practically everything, they are less likely to question or understand the now larger lump sum “Tax”.

However, Cabela’s (a retailer of hunting, fishing, camping, and related outdoor recreation merchandise), reportedly made an error by explicitly revealing one of the new taxes, the Medical Device Excise Tax (MDET), causing consumers to immediately question the tax.

The PPACA instituted a 2.3% tax on the first sale of medical devices beginning this year. According to the legislation,

…Section 4191 of the Internal Revenue Code imposes an excise tax on the sale of certain medical devices by the manufacturer or importer of the device…Generally, the manufacturer or importer of a taxable medical device is responsible for filing Form 720, Quarterly Federal Excise Tax Return, and paying the tax to the IRS…

Like most legislation, the wording is vague. In this case, the word “generally” would allow manufacturers and importers to pass the tax onto consumers with higher retail prices. Although lawmakers/politicians/regulators will almost never say it, the manufacturers and importers are not likely to pay the tax themselves if they can pass it on to the consumer.

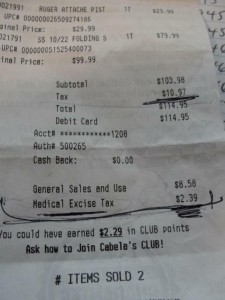

This past week, consumers of Cabela’s merchandise have been posting their purchase receipts on the internet with the itemized MDET tax. One of these receipts is shown below. In Cabella’s case, the additional MDET tax was likely a true error (versus an “error” that unhides the truth), because it is neither a manufacturer or an importer of medical devices. The error reportedly was a result of failing to properly program its updated receipt software that now has the MDET as an option for businesses if applicable.

If businesses were forthcoming in each and every tax they pass onto consumers, it may very well cause more consumers to push back on government and hold lawmakers/politicians more accountable for the tax burden they impose.